Xiaomi CEO Lei Jun’s Wealth Portfolio (2025)

Before exploring Xiaomi CEO Lei Jun Wealth 2025, let’s take a look back at the key stages of his life, as they are closely tied to his journey of wealth accumulation.

1, the student stage (1969 ~ 1991): born poor, good character, in 1987 with excellent grades into Wuhan University, including students during the entrepreneurship to earn the first bucket of gold, including the failure of entrepreneurship.

2, Kingsoft (1992 ~ 2007): in 1992 was begged Bojun to join Kingsoft, leading the WPS R & D, WPS success of the absolute creditors;

In 1998 as CEO, to promote the company’s expansion from office software to the game (“Swordsman Wonderland”), anti-virus (Kingsoft Antivirus) and other areas, led Kingsoft Hong Kong in 2007, a successful listing.

However, in ten years, Kingsoft four times to hit the door of the listing, but repeatedly rejected. Hong Kong GEM, Shenzhen GEM, A-share main board, U.S. stocks. Although in Kingsoft has long had the idea of leaving, but Lei Jun said, must lead the brothers listed, to the brothers is also an account of themselves. Kingsoft one day not listed, Lei Jun one day not leave. And this decade, the Internet is surging, Kingsoft seems to be always slow a beat, and many wind passes by.

3, the investor stage (2004 ~ 2011): Lei Jun in Kingsoft when the financial freedom, early on in the name of individuals invested in UC browser, YY, Vancl, etc., until the establishment of the “Shunwei Capital” in 2011, through the corporatization of the operation of the investment;

4, Xiaomi era: (2010 to the present): in 2010, the creation of Xiaomi, “hardware + software + Internet” way to cut into the mobile Internet, taking advantage of the rise of the Android ecosystem.

(1) Internet mode breakthrough period (2010 to 2015): through the “extreme, focus, word of mouth, fast” 7-word trick, through the “high configuration and low price” – the ultimate cost-effective approach Even killed off the “Huaqiangbei market”, which is famous for cheap Shanzhai machines. Â

(2) Eco-chain expansion period (2015-2019): expanding from a single cell phone business to an intelligent eco-chain, and constructing the dual engine of “cell phone + AloT”. At the same time, through the investment of more than a hundred ecological chain enterprises (such as Yunmi and Zhimi), covering smart home, wearable devices, etc..

3) Expanding high-end + human car home ecology (2019 to present): spinning off Redmi, Xiaomi as the main brand to impact the high-end market; the announcement of building a car in 2021, as well as the hot sale of Xiaomi SU7 in 2024 and the sealing of SU7 ultra this year.

Next, I will officially explore Xiaomi CEO Lei Jun Wealth.

Xiaomi CEO Lei Jun Wealth Part I: Xiaomi Group – Lei Jun’s core source of wealth

Lei Jun’s primary source of wealth comes from the tech giant he founded, Xiaomi Group. According to Xiaomi’s 2023 annual report, Lei Jun controls 24.2% of the company’s shares through a family trust (Ark Trust HK). As of February 27, 2025, this stake was worth approximately RMB 297.8 billion (based on market capitalization on that date).

Key details:

Lei Jun’s shares are dispersed among three entities; Smart Mobile Holdings, Smart Plaver Limited and Team Guide Limited, which are Xiaomi’s first, seventh and eighth largest shareholders, respectively, with a combined stake of 24.2%.

Xiaomi CEO Lei Jun Wealth Part II: Kingsoft – high control but limited real wealth

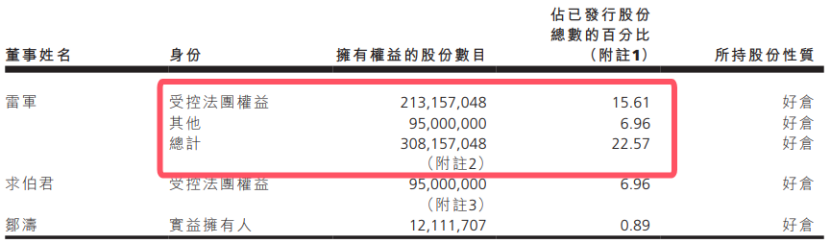

1. Kingsoft is the starting point of Lei Jun’s career, but currently contributes less to his wealth. Kingsoft, on the other hand, is the home base of the Kingsoft family. According to the annual report of Kingsoft 2023, Lei Jun is its major shareholder, with a total of 308 million shares of equity, accounting for 22.57%.

On the surface, Lei Jun owns 22.57% of the shares, but among them: 95 million shares belong to Jinshan founder beg Bojun, just the voting rights to Lei Jun. 38.34 million shares belong to Xiaomi Group, which is not counted in Lei Jun’s personal wealth.

Ultimately, what can be counted as Lei Jun’s personal wealth is the 175 million shares held by his wholly-owned Color Link Management Limited (registered in the British Virgin Islands), accounting for 13.05% of Kingsoft’s total share capital. Measured by Kingsoft’s closing market value of 52 billion yuan on February 27, 2025, the market value of this part of Lei Jun’s holdings is 6.8 billion yuan.

2. Kingsoft Cloud and Kingsoft Office

In Kingsoft Cloud, which was spun off from Kingsoft, Kingsoft holds 37.4% and Xiaomi Group holds 12.25%, which means that Lei Jun is able to control and influence 49.65% of Kingsoft Cloud.

But from the point of view of wealth calculation, Lei Jun’s personal direct shareholding in Kingsoft cloud is 0, so the wealth that can be counted is zero, and should not be double-counted. Lei Jun influences nearly half of the equity in Kingsoft Cloud, but the wealth of countable holdings is 0. Details can be seen in the chart below, and Green Better is also owned by Xiaomi Group.

Kingsoft system, the most extensive users, the highest market value of Kingsoft Office, 51.54% of the major shareholders – Kingsoft Office Application Software Limited, wholly owned by Kingsoft, and Lei Jun direct shareholding part is only embodied in a few employee shareholding platform. Among them, in the second shareholder tianjin qiwen five dimensional, lei jun personal holding 15.62%; In the sixth largest shareholder tianjin qiwen four dimensional, lei jun holding 5.63%; In tianjin qiwen seven dimensional, lei jun holding 42.86%.

Taken together, Lei Jun’s personal shareholding in Kingsoft Office, which should be calculated as wealth, is only 1.14% (4.75%*15.62%+1%*5.63%+0.79%*42.86%), valued at about RMB 1.8 billion.

Xiaomi CEO Lei Jun Wealth Part III: Shunwei Capital – the hidden value of the investment landscape

Shunwei Capital is Lei Jun’s family investment platform, focusing on technology and consumer sectors, but with complex valuations. Lei Jun has a wide layout in the investment field, and his investment is mainly carried out through Xiaomi technology, Xiaomi Yangtze River Industry Fund, and Shunwei Capital. Among them, the first two mainly rely on Xiaomi group to carry out, no longer repeat the calculation to Lei Jun’s body, and shunwei capital is more inclined to its family management, however, due to shunwei capital is not listed or issued debt, this piece of wealth value is relatively difficult to measure.

The official website shows that Shunwei Capital focuses on hard science and technology, intelligent manufacturing, Internet +, intelligent hardware, consumption, enterprise services, electric vehicle ecology and other fields, and has successfully invested in well-known projects such as Xiaomi, Aqiyi, Azure, Xiaopeng Automobile, Today’s headlines, fast hand, stone technology and so on.

Key Information:

Management: Lei Jun and his wife, Zhang Tong, hold a 100% stake in the main mainland company (Lhasa Shunwei).

Size under management: approximately RMB 43 billion, but actual value is subject to net asset calculation.

Reference peers: The net assets of head VC firms (e.g. SZV, Orient Fortune) are about 6%-10% of the management scale. Based on this projection, Shunwei Capital’s net assets are about RMB 4 billion.

From past cases, Lei Jun’s wife, Zhang Tong, played an important role in Shunwei Capital’s GP.

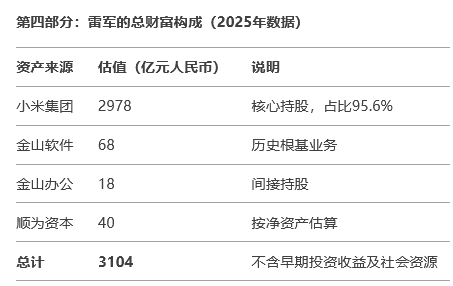

At this point, the Lei Jun family’s shareholding wealth map is relatively clear. Calculated according to the closing price on February 27, 2025, the market value of its holdings in Xiaomi Group is 297.8 billion yuan, the market value of its holdings in Kingsoft is 6.8 billion yuan, the market value of its holdings in Kingsoft Cloud is 0, and the market value of its holdings in Kingsoft Office is 1.8 billion yuan, together with the value of Shunwei Capital which is worth about 4 billion yuan, Lei Jun’s total wealth is roughly 310.4 billion yuan.

Note: As for Lei Jun’s early angel investment in his personal capacity to obtain excessive returns, should be mostly used in Xiaomi, Shunwei and other entrepreneurial process, here will not repeat the calculation.

Beyond Spreadsheets

Lei Jun’s true wealth lies not in financial metrics, but in decades of cultivated relationships that powered the SU7’s success. This electric vehicle breakthrough demonstrates how strategic alliances and social capital – forged through entrepreneurship and cross-industry trust – ultimately drive market triumphs that balance sheets alone cannot achieve.